Generating a good and stable credit score has turned out to be an obvious requirement by every other responsible citizen in India. With the establishment of CIBIL (Credit Information Bureau India Limited), such prerequisite got stapled with major significance. The information that the creditors or loan providers get to obtain from this informative unit helps them to get related with the set of potential borrowers. As it is a perfect place to record past credit history of every individual, creditworthiness can be obtained with feasible beneficence too.

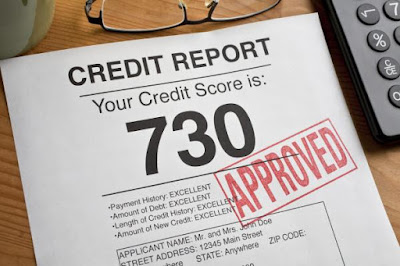

Analysed information approves the fact that the credit score that remains in between 700 to 900 is considered to be good. Those who are the victims of bad score evidentially desire to improve CIBIL rating. Getting hold of all these aspects can be successively fulfilled on following some of the essential features. First and fore-most is to block any sorts of unnecessary credit applications on the discovery that the loan got rejected for bad credit score. Linked with it is the necessity to pay-out every other debt amount to improve the rating pattern. No wonder, proper maintenance of debt portfolio is the best way to enjoy the advantages of good credit rating under CIBIL. Added with it is the vitality of using the credit amount in a most productive mannerism too. In this aspect, merging the entire loosened debt amount is a significant feature also. But then, checking and keeping a proper track of credit records is of utmost necessity.

Capability of gaining the desirable loan amount gets automatically graphed down with the help of appropriate CIBIL score. Although the bureau allows to be related with CIBIL rating calculation on payment of certain charges, enterprise associated with allocating such evaluation pattern is of supreme aid too. Updated technology and algorithm that are used to execute such crucial calculation assures that the score is truthful and accurate. Hence, the borrower can be associated with such imperative score at the verge of loan or credit application. With no sorts of registration process at the initial stage such reckoning rating system is of apt assistance as a whole.

No comments:

Post a Comment